Invoice factoring / accounts receivable financing

Need a stable credit provider who can handle all your frequent short-term credit needs? Try us now. See how we get you the money fast. Get Started

Need a stable credit provider who can handle all your frequent short-term credit needs? Try us now. See how we get you the money fast. Get Started

Financing terms are counted by days, as flexible as your credit needs.

Daily invoice financing rates are lower than our competitors. No set-up fee for repeated customers.

We want to be your one-stop credit provider for all your needs.

Our set-up fee and daily factor rate are specified clearly.

We know you want to stay focused on your business instead of burdensome applications or constantly looking for better rates. So we provide industry's best invoice financing rate. We are your one-stop credit provider for all your short-term credit needs.

Here’s how it works

Apply in 10 minutes with basic details about your company and your customer business.

American Credit will review your application and make a decision on the same or the next day.

Upload your invoice. Established clients can upload invoices again when needed.

You get the rest of the receivable minus the fee after your customers pays the invoice.

See our process

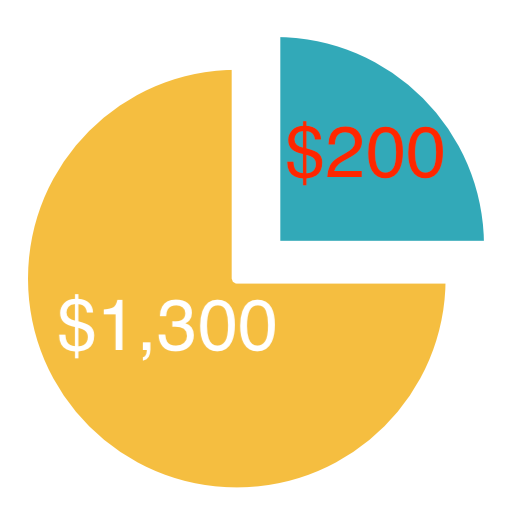

Apply and approved

$10,000 invoice

$8,500 advanced to you

Paid to net 30 by your customer

$9,800 total paid to you

What is the Difference between Invoice/AR Factoring and Financing?

The primary difference between factoring and bank financing with accounts receivables involves the ownership of the invoices.

Read the full article about Receivable Financing vs Factoring

What is invoice factoring? What is the purpose of invoice factoring? How does it work? We answer all these questions and more in this detailed article on invoice factoring.

Read the full article Invoice Factoring Explained

A growing family business keeps you running 24/7. I can't spend days applying and months waiting for a loan. We need a credit provider who can not only provide quick business invoice financing but other cash flow loans for business as well.

Alessandra Ale

CFO, Silicon Valley Staffing Services

American Credit: the difference you can trust

You work hard. We work hard. We share the same ethic. That’s why we go the extra mile to look at your situation and see if we can help. Unlike some business credit lenders who focus on FICO scores, we look at your business as a whole.